Thrilled to be recognized for our participation in DAIS 2025! With 250+ in-person and 500+ virtual attendees, the summit connected global investors and thought leaders. Arpit Shah, Co-Founder & Investment Director, shared insights on ‘New Moats of Old Age Business,’ exploring unique investment strategies.

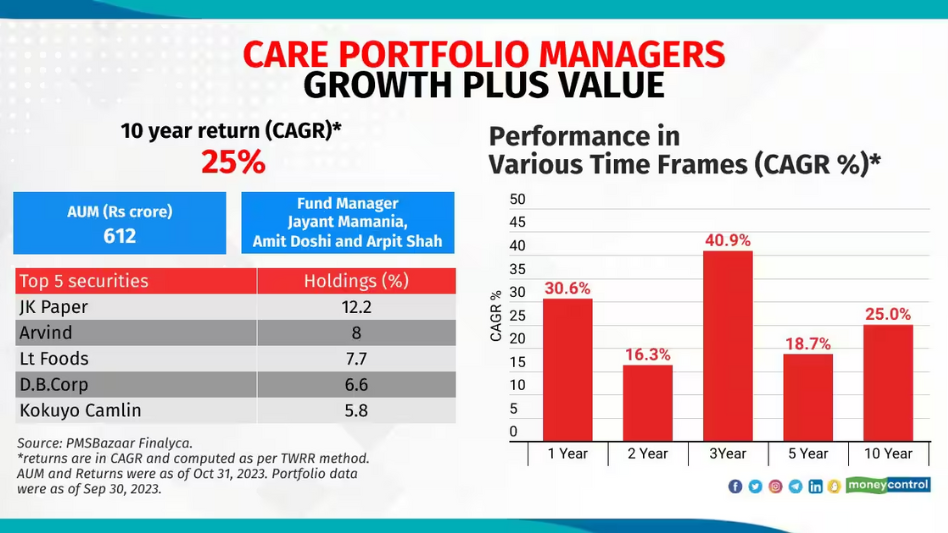

Care Portfolio Managers Pvt. Ltd. was able to navigate volatility in the market in the past 10 years with high conviction investments into small cap stocks. Arpit Shah – Investment Director, Care PMS – explains, “Over the past decade, we’ve consistently maintained a 70%+ exposure to small-cap companies, at times reaching as high as 85%.

Finance Minister Nirmala Sitharaman made a number of announcements on agriculture, generating employment, and reduction in import duties for gold, and silver, among other things. Here are five stocks which market experts believe are likely to benefit from the announcements.

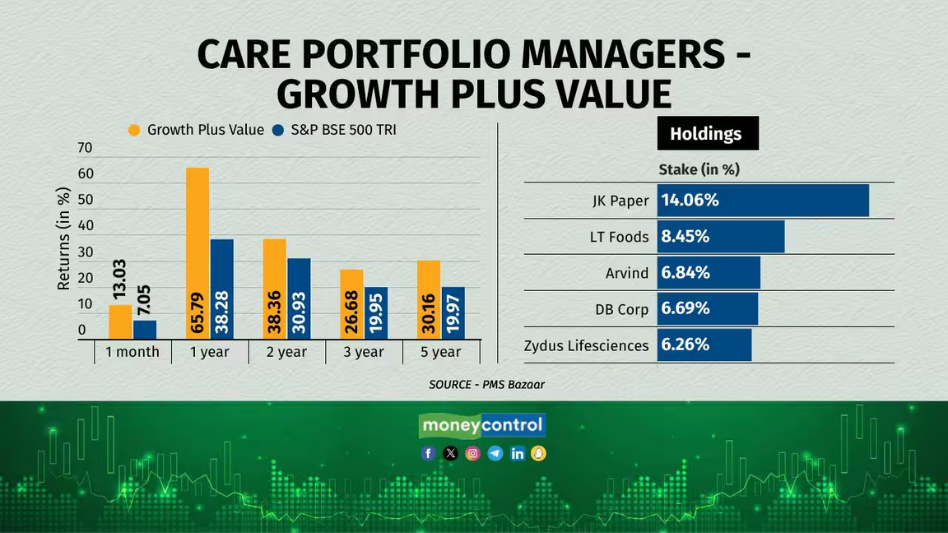

The portfolio is managed by Jayant Mamania and was started in 2011. It has an AUM of Rs 854 crore. The PMS’ top five sectors are paper and packaging, textiles, pharma, packaged foods, and stationery.

India’s renewable energy stocks have enjoyed a scorching rally for the past two years as retail buyers pile in, but their extended valuations are flashing warning signs.

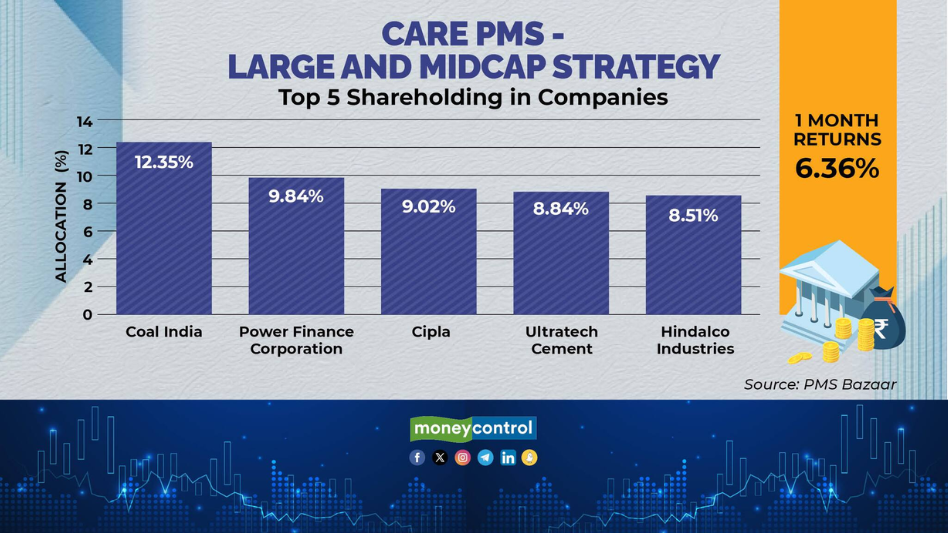

These strategies have held major allocation to mid- and small-cap stocks. But remember, PMS schemes come with a minimal investment of Rs 50 lakh and are meant for high-risk taking investors.

Nearly 63 per cent, or 205 of the 326 PMS schemes, were able to beat the returns generated by the benchmark, data from PMS Bazaar shows. The 326 schemes collectively delivered average returns of -2 per cent, higher than the -2.7 per cent given by the benchmark.

Jayant Mamania, a fund manager with 20 years of experience heads the PMS Care – Large and Midcap strategy fund, which is a 4 years old fund. The fund has more inclination towards metals and BFSI. The fund has performed better than the benchmark S&P BSE 500 in the last year.

In an interview with ETMarkets, Shah who brings in more than 15 years of experience in the capital markets said, “We advise investors to be company specific, and when you see sharp movement in the price it is advisable to keep rebalancing portfolio.”

𝐒𝐡𝐚𝐫𝐩𝐞𝐧 𝐘𝐨𝐮𝐫 𝐄𝐪𝐮𝐢𝐭𝐲 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐒𝐤𝐢𝐥𝐥𝐬 𝐰𝐢𝐭𝐡 𝐑𝐞𝐝 𝐅𝐥𝐚𝐠 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 – 𝐓𝐡𝐢𝐬 𝐅𝐫𝐢𝐝𝐚𝐲 (28𝐭𝐡 𝐍𝐨𝐯) 𝐚𝐭 04:30 𝐏𝐌!

Join us for an exclusive webinar with 𝐌𝐫. 𝐀𝐫𝐩𝐢𝐭 𝐒𝐡𝐚𝐡, 𝐂𝐨-𝐅𝐨𝐮𝐧𝐝𝐞𝐫 & 𝐃𝐢𝐫𝐞𝐜𝐭𝐨𝐫, 𝐂𝐚𝐫𝐞… pic.twitter.com/PcNrI7utnN

— pms bazaar (@PmsBazaar) November 24, 2025

“Buying overvalued stocks, even if they are well-known blue chips, is not conservative. A conservative approach requires buying at a price that offers value, not succumbing to market hype or inflated valuations.”

-Warren Buffett’s 1961 LetterThis timeless philosophy from Mr.… pic.twitter.com/UVqzld53ej

— Care Portfolio Managers | Care PMS (@carepms) November 1, 2025

Watch our Investment Director, Mr. Arpit Shah share insights on India’s market outlook, key sectors to watch, and how investors should adapt their lens while evaluating India’s valuations.@Arpit_Care_PMS https://t.co/UHQ7x22nBD

— Care Portfolio Managers | Care PMS (@carepms) October 9, 2025

A Green Tribute : Care PMS Plants 75 Trees for PM Modi’s 75th Birthday. 🌱

Wishing Prime Minister Modi a very happy 75th birthday and great health! 🌟

His tenure has been marked by bold, forward-looking reforms, from strengthening Make in India and digital initiatives, to tax… pic.twitter.com/YvNrU99Lfs— Care Portfolio Managers | Care PMS (@carepms) September 17, 2025

Markets have been challenging, but our “Large & Midcap” strategy remains steady – down just -0.3% in 1 month and still holding #1 spot on PMS Bazaar.

Built on resilience, ready for the rebound. pic.twitter.com/co13bFg6ea

— Care Portfolio Managers | Care PMS (@carepms) September 1, 2025

🎙️ Stock Selection & Exit Case Studies with 𝐂𝐚𝐫𝐞 𝐏𝐌𝐒 (@carepms) Investment Director – Mr. 𝐀𝐦𝐢𝐭 𝐃𝐨𝐬𝐡𝐢 (@amitndoshi)

Listen to our latest episode of 𝐨𝐮𝐫 𝐏𝐌𝐒 𝐁𝐚𝐳𝐚𝐚𝐫 𝐏𝐨𝐝𝐜𝐚𝐬𝐭 𝐜𝐨𝐯𝐞𝐫𝐢𝐧𝐠 𝐚 𝐜𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐫𝐚𝐧𝐠𝐞 𝐨𝐟… pic.twitter.com/lIxGmU2RSR

— pms bazaar (@PmsBazaar) March 25, 2025

Care PMS Featured in Gulf News!

Exciting news! Our participation at the Dubai Alternative Investment Summit (DAIS 2025) has been highlighted in Gulf News, recognizing the event’s impact on the alternative investment space. pic.twitter.com/6vm0FknXp1

— Care Portfolio Mgr.. (@carepms) February 27, 2025

PMS Bazaar data reveals that all the equity PMS categories have delivered over 35% return on average in the past year beating the market, represented by Nifty 50 return of 33%.

Check out our latest blog presenting the category wise analysis of PMSes based on 1-year returns.… pic.twitter.com/LHt3UVl7w8

— pms bazaar (@PmsBazaar) September 25, 2024

What are the 3 key criteria for selecting the right stocks in the small & mid-cap segment? Expert fund manager Arpit Shah (@Arpit_Care_PMS) answers in our latest Fund Manager Brief.

In this edition, the Co- Founder & Investment Director of Care Portfolio Managers (@carepms)… pic.twitter.com/fPqWi7qa8W

— pms bazaar (@PmsBazaar) September 23, 2024

A Heartfelt Thank You to Our Incredible Community! 🌟

With immense gratitude, we are thrilled to announce that, thanks to your mighty support & unwavering loyalty, Care PMS has surpassed ₹1000 Cr in AUM, achieving 24% CAGR since inception & outperforming all market indices. pic.twitter.com/poPKzTGj7k

— Care Portfolio Mgr.. (@carepms) September 4, 2024

Finance Minister Nirmala Sitharaman made a number of announcements on agriculture, generating employment, and reduction in import duties for gold, and silver, among other things. Here are five stocks which market experts believe are likely to benefit from the announcements. pic.twitter.com/Tvos1FEEd3

— Care Portfolio Mgr.. (@carepms) July 24, 2024

On July 14th, Care PMS had the privilege to engage with a distinguished group of doctors at Hotel Sea Princess, Mumbai. pic.twitter.com/hbpCFUgSbG

— Care Portfolio Mgr.. (@carepms) July 17, 2024

We are thrilled to announce that Care Portfolio Managers has been recognized among the top 10 PMSs for June, showcasing exceptional returns! pic.twitter.com/qz0AsuO1g5

— Care Portfolio Mgr.. (@carepms) July 15, 2024

Amit Doshi, Fund Manager, Care Portfolio Managers Pvt. Ltd. was live on DubaiEye 103.8 last month discussing the vibrant future of Indian markets & the impact of elections.

Gain expert insights on how political events shape financial landscapes. #MarketOutlook #ElectionImpact pic.twitter.com/Iuqy5YhXdS

— Care Portfolio Mgr.. (@carepms) July 4, 2024

Last month, the Care PMS team embarked on an exhilarating offsite adventure to Anchaviyo Resort in Wada from June 21st to 23rd. 🌴🌊 It was an unforgettable experience, filled with games, celebrations, and deep discussions that brought us closer together. pic.twitter.com/M83TtprKNj

— Care Portfolio Mgr.. (@carepms) July 4, 2024

Today marks a significant milestone as we celebrate the 17th Foundation Day of CarePMS!

Established in 2007, Got license in 2011, we’ve grown to manage 900 crores in assets while serving over 700 clients worldwide. Our journey of commitment, trust & success continues to evolve. pic.twitter.com/NqoMHFJLuk

— Care Portfolio Mgr.. (@carepms) July 3, 2024

On June 14, 2024, CA Amit Doshi, Director at CarePMS, delivered an enlightening talk at the Jain Chartered Accountants Federation (JCAF) event held in Borivali-West. The insightful session focused on “Old Age Business – Dying or Worth Investing?” pic.twitter.com/vkNOYN3Yfa

— Care Portfolio Mgr.. (@carepms) June 20, 2024