Over the last 2 years, markets have been kind to investors globally mainly led by loose monetary policy. With worries cropping up on multiple fronts, there has been a reset in investors sentiments and liquidity. Some of the reasons for sharp fall in the last couple of months are as follows:-

1) Very high inflation leading to monetary tightening (US reported inflation of 8.4% in May 2022); 2) Oil prices have risen sharply on growing geopolitical tensions (~$120 per barrel); 3) No easing in Russia-Ukraine conflict; 4) COVID related lockdown in China worsening supply chain issues.

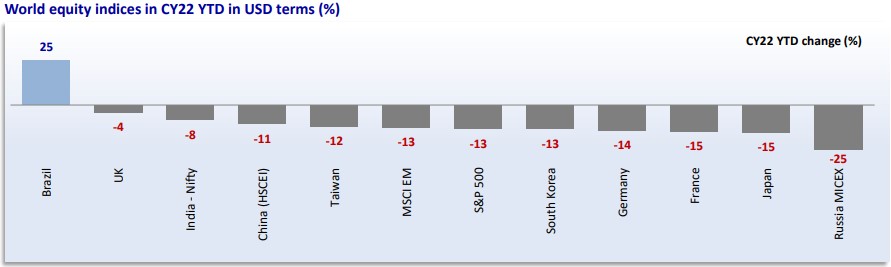

The Indian stock markets following the global cues have been in correction phase since start of 2022 on the back of continuous FII selling (continued for 8th consecutive month). Also, a bit of surprise of rate hike by RBI well before the next scheduled MPC meeting also impacted the market sentiment over concern of high inflation. However, we seem to have fared far better with 7-8% drawdown from highs vs all other major markets correcting more than 10%.

However, the same is not true for a lot of mid and small-caps companies which have fallen significantly (more than 25%) from highs. Another

phenomenon which was noticed was that a lot of market fancy growth stocks which were in the overvalued zone have corrected significantly whereas value stocks have done better.

Notwithstanding the impact of 3rd wave of COVID and high inflation impacting private consumption, Indian economy grew by 4.1% in Q4’22 and ended the year with GDP growth of 8.7% However, when compared to pre-pandemic year of 2019-20, we have grown by just 1.5%.

Outlook for FY23 seems clouded on the back of significant increase in crude oil price at $120/barrel as well as huge spike in inflation which was a 8-year high at 7.8% in April 2022. However, normal monsoon prediction along with rise in farm income due to record crop prices coupled with pro-active steps from the government on reducing the impact of inflation; whether by cut in fuel prices or banning exports to control; may improve the demand and cushion the impact on GDP to some extent.

While there was a lot of uncertainty w.r.t both global as well as domestic factors, all eyes were fixed on Q4’22 earnings performance. Corporate earnings were healthy and instilled a ray of hope but there was wide divergence between sectors affected by rising RM prices and those not affected/benefitted by rising prices.

For Nifty in Q4’22, revenues grew by 23% Y-o-Y whereas EBIDTA growth at 16% was lower due to margin pressures on account of rising costs. BFSI, Oil & Gas, Metals, Chemicals, Textiles and Auto delivered better performance whereas IT, Pharma, FMCG, Cement and Consumer focused companies reported poor performance.

We expect the full impact of elevated input costs to come in H1’23 as most companies had some low-cost RM inventory as well as uncertain macroeconomic condition to keep investor sentiment muted in short-term. However, after the steep correction, Nifty trades at ~19x FY23 EPS which is around its 10-year average PE. Hence, we don’t see significant downside and one should add funds on any material correction.

As far as our portfolio companies are concerned, except cement and pharma, most of the companies delivered double digit bottomline growth and yes like other mid and small cap companies they have also corrected in the range of 10-25%. The valuations of those companies are at a fairly comfortable level and gives us comfort in holding.

2022 started with rising interest rates, high inflation and continued disruption in supply chain with Russia-Ukraine crisis creating geo-political issues and its impact on various commodity prices. Uncertainty is high, investing is more complicated and we believe, active stock selection is all the more important as understanding company’s ability to navigate higher inflation can be the key to success.

On the back of various uncertainties in the global markets as well as earnings pressure in Indian markets expected over the next 2 quarters, markets after giving super returns for last 2 years are expected to be choppy and volatile and one needs to be patient and make use of some opportunities arising during this volatility.

We would like to end the update with the following quote:

“A 10% decline in the market is fairly common. Investors who realize this are less likely to sell in panic and more likely to remain invested, benefitting from the wealth building power of stocks”

– Christopher Davis