as on May 31st, 2024

Invest in Indian listed companies via fundamental research backed ideas to compound capital over the long-term. The Strategy involves a greater allocation towards small-cap companies exhibiting sunstantial business growth rates available at reasonable valuation

- Managed by experienced team of CAs

- Sector-agnostic, Bottom-up, Stock-specific portfolio

- Holding period >15-18 quarters

- Blend of Growth and Value Investing

- No leverage

- Fully invested at all times

- 70% exposure to small-cap

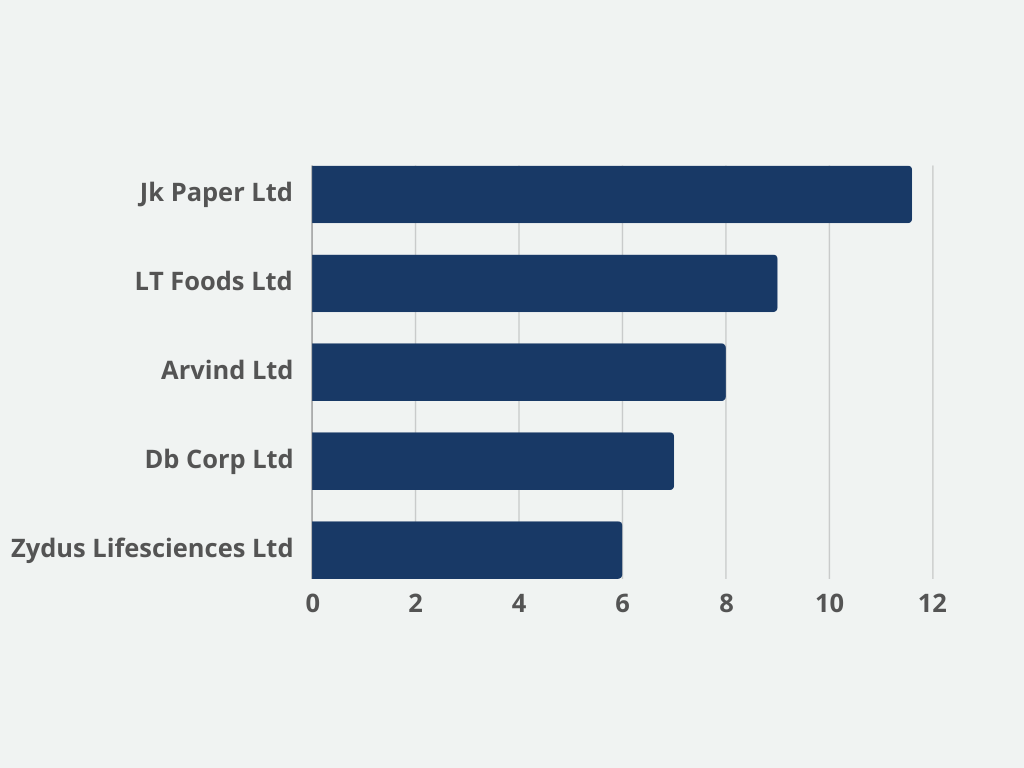

- 18-20 stocks

- Max single stock weight 12%

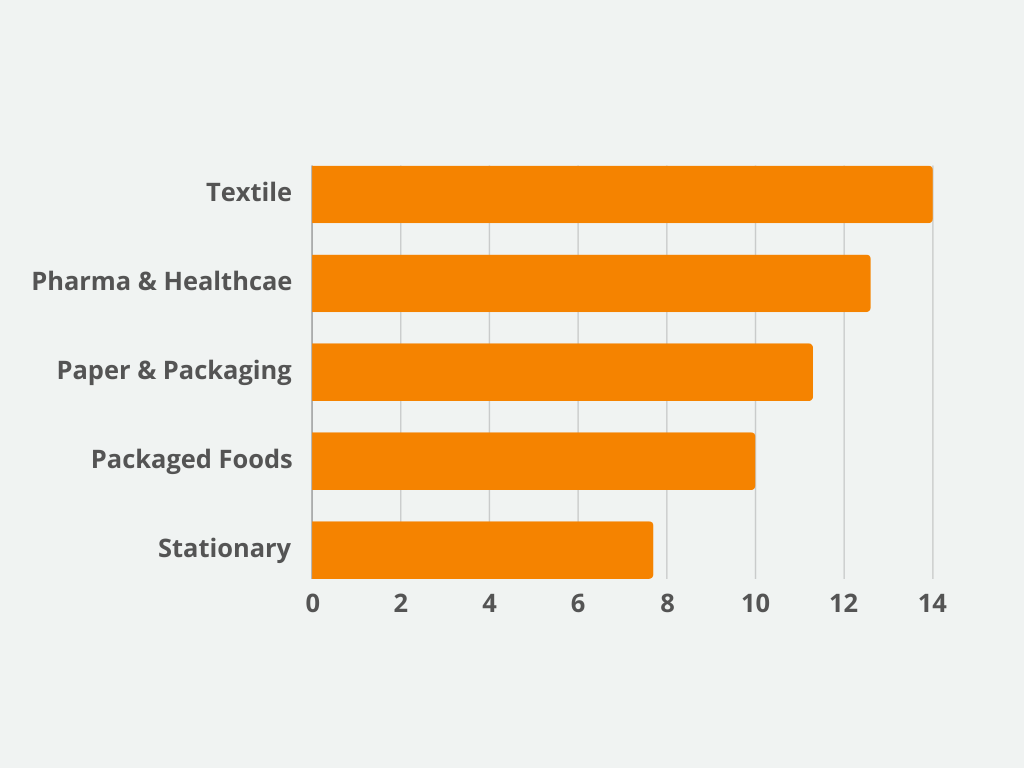

- Max single sector weight 20%

| Period | 1 month | 3 Months | 6 Months | 1 Year |

| Care PMS Growth Plus Value | 0.9 % | 6.4 % | 11.4 % | 55.4 % |

| BSE 500 TRI | 0.8 % | 5.2 % | 17.7 % | 34.7 % |

values in nearest percentages

Care PMS utilizes key financial ratios to evaluate the performance and valuation of investments. Notably, the Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio are essential metrics. The P/E ratio assesses a company’s current share price relative to its earnings per share, while the P/B ratio compares the market value to the book value of a company’s assets. These ratios provide valuable insights for investors, helping them make informed decisions.