Care PMS Large & Midcap

as on August 31st, 2024

Investment Objective

Invest in 15-20 companies with sustainable business that endure across market cycles from the universe of top 250 companies by market capitalization.

Know Your Investment Approach

Large & Midcap

Key Features of the Portfolio

- Investing in only listed Indian Companies

- No exposure to derivatives

- Holding period >12-15 quarters

- Blend of Growth and Value Investing

- Maximum single security exposure 12 %

- Maximum Single Sector exposure 20 %

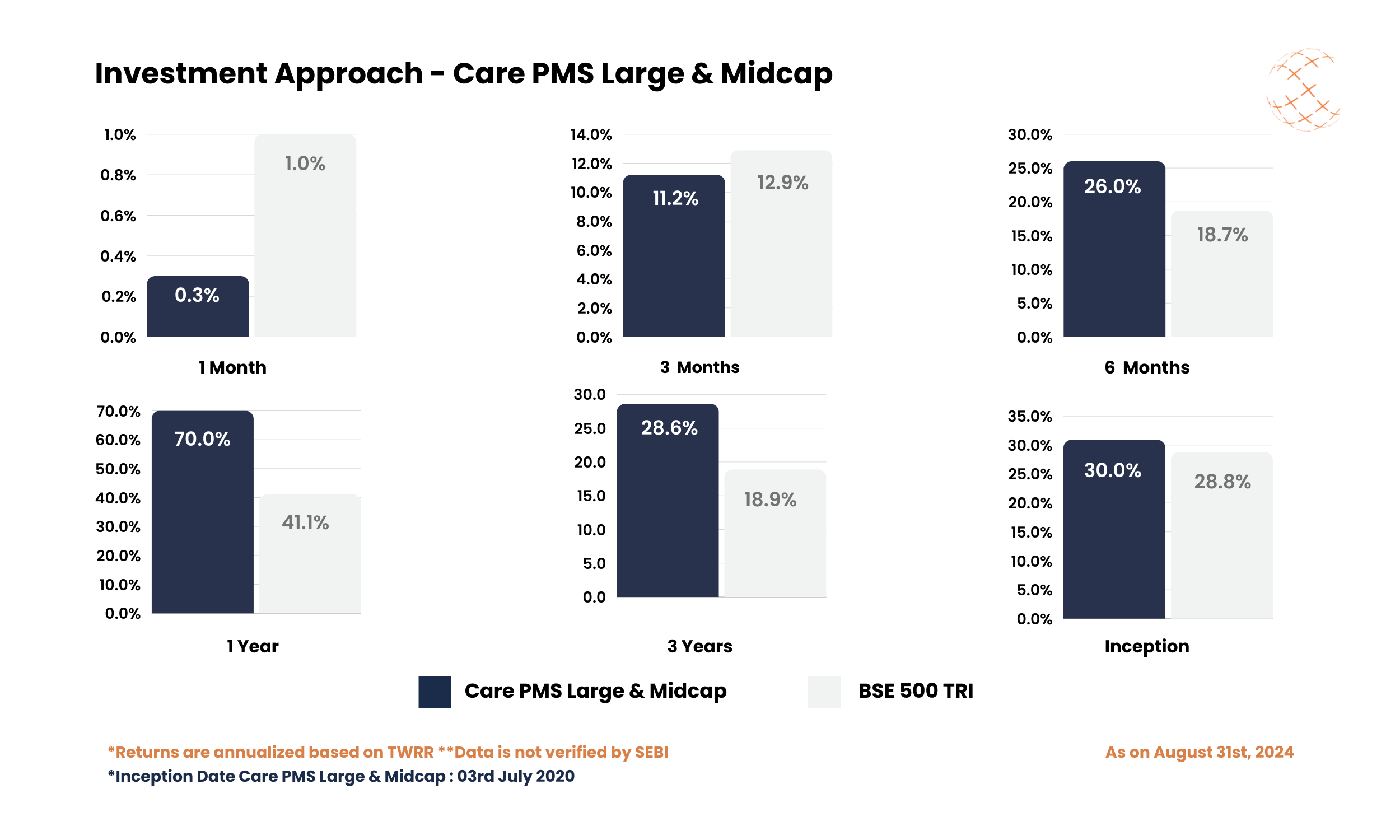

Performance

Investment Criterion

Asset Allocation

Market Cap

values in nearest percentages

Financial Ratio

Care PMS utilizes key financial ratios to evaluate the performance and valuation of investments. Notably, the Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio are essential metrics. The P/E ratio assesses a company’s current share price relative to its earnings per share, while the P/B ratio compares the market value to the book value of a company’s assets. These ratios provide valuable insights for investors, helping them make informed decisions.

0

P/E Ratio

0

P/B Ratio

Top Sectors

Top Companies

values in nearest percentages

Disclaimers

- *Investment into equities are subject to market risk. Please read the disclosure document carefully before investing.

- *Returns are not verified by SEBI