Despite rising protectionism and the sluggish growth outlook for Euro-zone and China, global growth remained resilient at around 3.2% for Calendar Year 2024. For the 2nd year running, the US economy surprised on the upside whereas hopes of a recovery were partially dashed in Europe and China. The American consumer remains the main driver of global demand whereas European and Chinese economies are facing deep-seated structural challenges, be it industrial malaise in Germany, fiscal irresponsibility in France or the deflating of property bubble in China.

Most of the baseline forecasts are for the above global story to broadly persist in 2025 as well, with the global economy expected to grow at 2.6%.

The “Trump unknown”

Any economic forecasting scenario inevitably depends on certain random factors, “unknowns” affecting the political situation, monetary and fiscal decisions, trade frictions and diplomatic relations. In 2025, all these questions converge on Donald Trump. As President Trump embarks on his new term, his economic policies are expected to shape the global landscape in the coming times.

The annual Economic Survey, which was presented in parliament by Finance Minister Nirmala Sitharaman, has projected Indian GDP growth to be at 6.3%-6.8% in 2025-26 vs 8.2% growth in 2024-25 i.e. a four-year low.

However, India’s Consumer Price Index (CPI) inflation eased to 5.22% in December 2024, marking a four-month low and continuing its downward trend from 5.48% in November. This resulted in RBI cutting repo rate by 0.25 bps in its February 2025 meeting which along with liquidity infusion of 150000 Cr announced recently should give the much needed support to growth.

Further, strong rural demand, expected recovery in government spending, tax relief and positive fiscal measures from the Union Budget 2025-26 are expected to propel the economy forward. However, rising geopolitical risks, inflationary pressures and a stronger US dollar are some of the key risks that one needs to track carefully.

Markets have been on a steady downtrend since making their peaks in Sep’24 and the sharp fall in Jan and Feb so far, has started to create panic among market participants. Investor conversations have begun to shift from ‘Buy the Dip’ to ‘How much Cash should one keep in the Portfolio’ and questions over India’s growth story have started resurfacing as FII’s have continued to sell unabated leading to four consecutive months of negative returns.

However, FII’s stake in Indian listed stocks has fallen steadily to below 18% (Sep’24 end) from 22.5% in last 10 years and this figure would further trend lower by Mar’25 end due to ongoing large FII selling. We are not sure on how the FII flows would trend going ahead but we don’t see them remaining at such insignificant scale in the next 5Y/10Y.

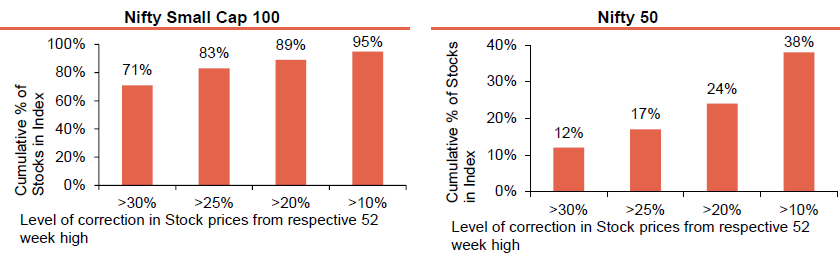

The below table shows the pain in the broader markets despite only modest correction being witnessed in Nifty Index.

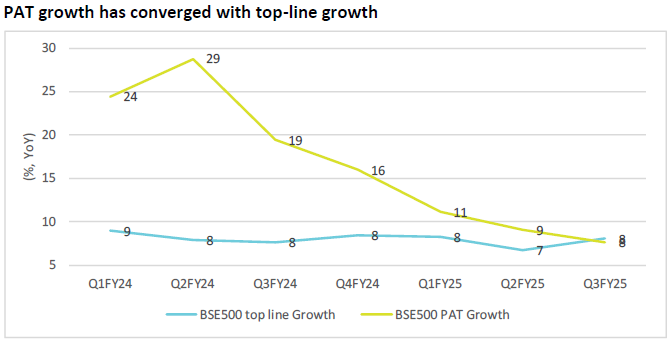

BSE 500 companies witnessed a top-line growth of 8% for Q3’25 despite a favourable base, which can be considered as poor. This is now the 7th quarter of sub 10% growth for BSE 500 companies.

FY24 experience strong profit growth of over 20% despite weak demand (sub 10%) due to favorable input prices. However, the divergence now appears to be reconciling, with profit growth slowing sharply to 8% in Q3’25.

The Q3’25 corporate earnings scorecard was driven once again by BFSI, with positive contributions from Technology, Telecom, Healthcare, Capital Goods and Real Estate whereas sectors such as Cement, Chemicals, Consumer Durables, FMCG, Oil & Gas and Metals continued to be under pressure.

Though the Q3’25 earnings are in-line with the modest expectations; however, forward earnings revisions are the weakest in recent times with the earnings upgrade/downgrade ratio of 0.3x, being one of the worst since Q1’21.

There are arguments on both sides on how to position from here on since we have witnessed a sharp correction in majority of the mid and small caps – 72% of Nifty mid cap / 83% of Nifty small cap stocks have corrected > 25% from their respective 52wk highs.

However, for BSE 500, consensus is building PAT growth of 14-16% each for FY26 and FY27 (versus 9% in 9M’25). We think this is likely to disappoint given the underlying macro-micro backdrop and are thus ripe for further downgrades.

Further, historical evidence suggests a tight relationship between flows and forward returns. Therefore, if the market correction deepens, we do not rule out domestic flows to moderate (or trigger redemptions) which could further exacerbate the correction in certain categories.

So overall there has been reasonable correction in most of the stocks and the mood is likely to cheer up once the growth numbers start throwing up well in the coming quarters. There are few triggers which can make that possible viz., public spending, revival in consumer spending, liquidity push by RBI and the moving away of fear of trump tariffs.

As far as our portfolio is concerned, the results have been decent barring 4-5 companies which we shall consider for churning in these opportune times. Overall, since last many quarters, we have been disciplined to stick to the fundamentals and have stayed away from high growth companies at richer valuations and we continue to be very selective by focusing on stocks where we are reasonably confident of improved performance over the next 2-4 quarters + where the valuations post the recent fall have become attractive.

We would like to end the update with the following quote:

“For an investor who knows what he is doing, volatility creates opportunity.”

– John Train